The Rivin Thesis

The secret plan for world commerce domination

Hey Friends 👋

After many requests to make my startup theses public…

Here we go.

Problem

Suppliers have giant spreadsheets of in-stock inventory.

There is no good way to analyze this inventory at scale.

Solution

Scan spreadsheets in seconds to find profitable products on any marketplace.

“How Do You Know The Problem Exists?”

I’ve had this problem, my friends have had this problem, and paid solutions exist.

Target Customer(ICP)

Intially Amazon Sellers → Walmart/Amazon Sellers → Noon/Amazon Sellers → All Sellers

“Competition”

ScanUnlimited.com — Currently 40% of the US Amazon market at $70/month

Analyzer.tools — Currently 30% of the US Amazon market at $49/month

Manual Sourcing — 20% of the US Amazon market

Other tools — 10% of the US Amazon market

In emerging markets, manual sourcing is 100% of the market. People copy and paste product codes into google one-by-one from their spreadsheets.

Why The “Competition” Is Not Competition

The incumbents are focused on creating “depth” for US Amazon sellers.

They are building supplier databases, IP databases, and adding services for US Amazon sellers.

I believe focusing on developing markets(“width”) is better.

People are familiar with the problem, know the software exists for the US Amazon market, and have no switching costs— as no solutions exist for their markets.

This means Walmart, Noon, and emerging market sellers.

Our Differences

More accurate

More affordable

Work across all Amazon + Walmart + Noon marketplaces

Why Now?

In developed marketplaces with the release of Walmart.com, many sellers are now selling on both platforms. There are no good tools that help them optimize operations across both platforms.

Emerging markets (e.g. MENA) have no tools for Amazon sellers.

Why Me?

I’ve been in e-commerce since 2018, and previously scaled two Amazon businesses to over $25,000+ per month.

In addition to being a seller, my last e-commerce SaaS startup scaled to $125k+ ARR before failing.

I know the space.

Pricing

$49/month for Amazon Sellers

$69/month for Walmart Sellers

$69/month for Noon Sellers

Risks

There may be no reliable distribution (Dead Zone).

Large developed market sellers may be hesitant to switch.

World Domination

Charge $99/month for our software when it works across more marketplaces

Every seller in our emerging markets buys our software (~600,000 sellers)— $712M+ ARR

Every seller in developed markets buys our software (~3M sellers)— $3.5B+ ARR

Every seller in all developing marketplaces buys our current software (~8.5M sellers) — $10B+ ARR

Add features and up pricing to ~$299— $30B+ ARR

Sell the data as an API to startups and companies like Honey — XXB+? ARR

We will become how businesses analyze inventory throughout the world.

Traction

Note: “MRR” means monthly subscriptions

$49 MRR — January(Beta)

$147 MRR — February(Beta)

$352 MRR — March(Beta)

$607 MRR — April(Launch)

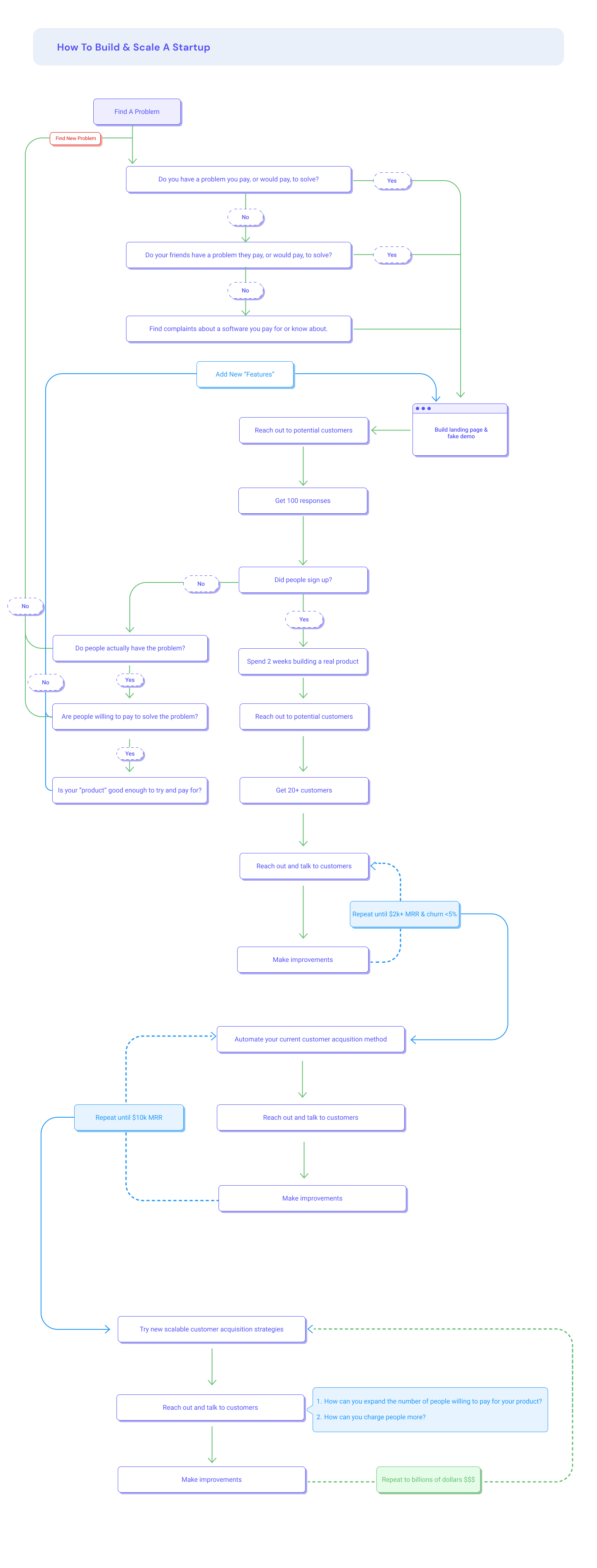

Stage: Currently talking to customers and making our product better.