How To Scale A Startup — User Acquisition Guide.

PMF, Finding Distribution, & Scaling.

Congratulations! You’ve just released a great product you’ve spent months creating!

There’s only one problem— no one’s buying.

Many startups, and a lot of first-time founders, expect paying users to materialize and instantly start buying their product on release.

Most people believe in the philosophy “If you build it, they will come”.

But, this isn’t how the world works.

So how do you get your first users?

One of Paul Graham’s most famous essays is “Do Things That Don’t Scale”.

In it, one of the Godfathers of Silicon Valley describes the process of acquiring first users through methods that don’t scale.

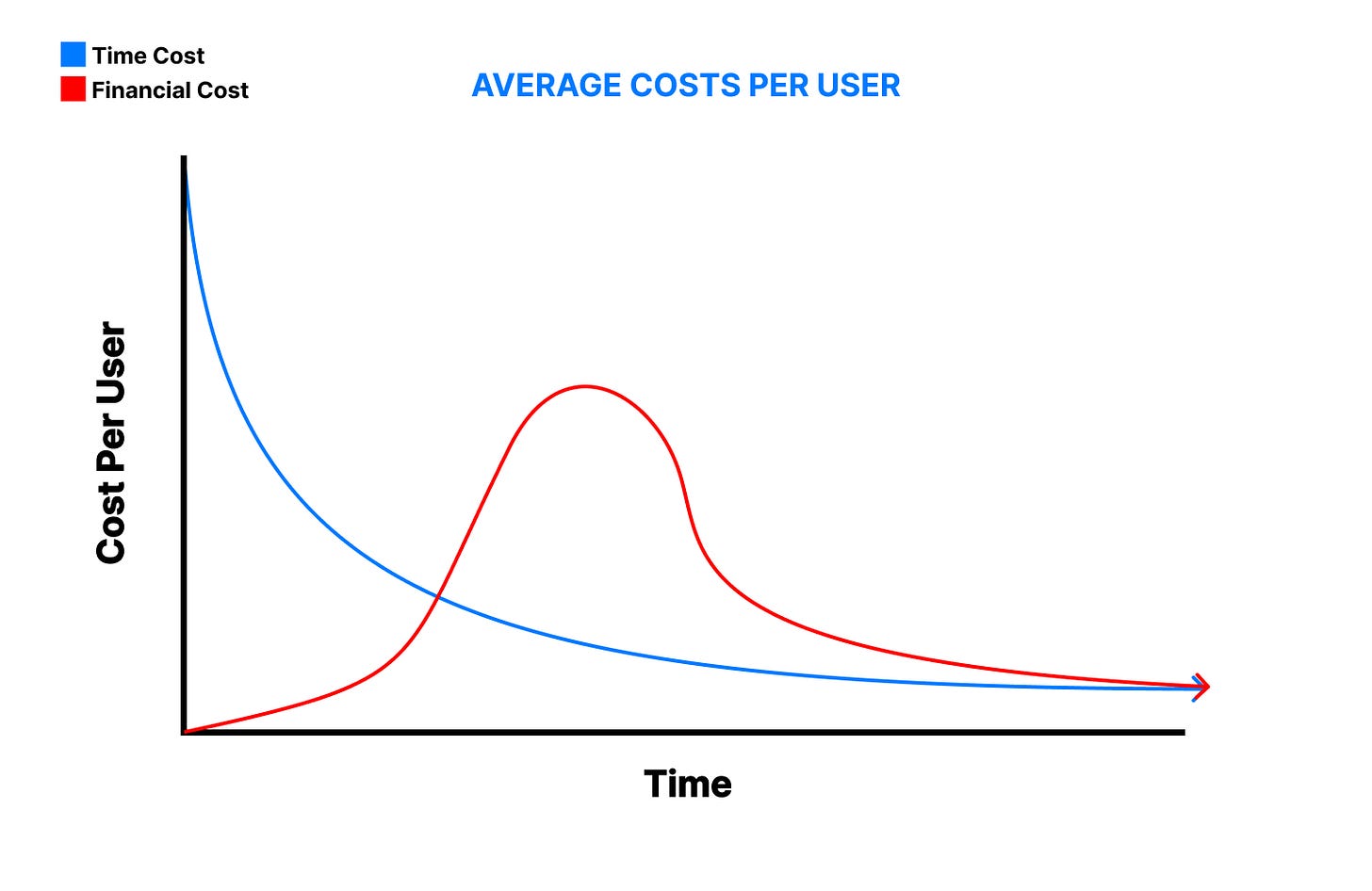

Ultimately there are two ways to acquire users, through time cost & through financial cost.

In an early-stage startup, you don't have money to spend on grand user acquisition strategies.

There isn’t a six-figure ads budget to A/B test with.

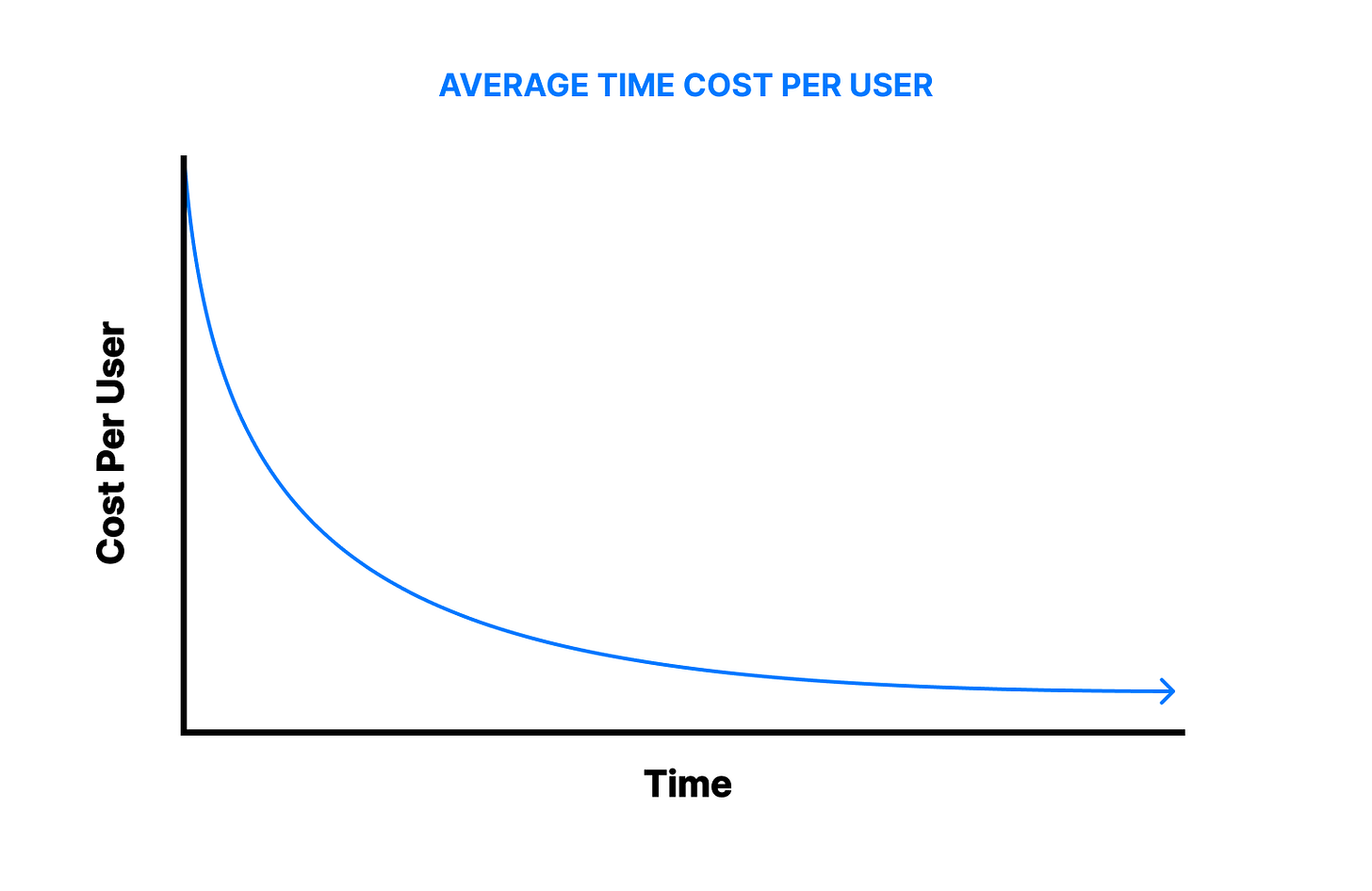

You must acquire your first users not through financially expensive means—but rather through time-expensive means.

You have to sell your product to your friends and family, promote it through various channels of social media, and use other methods where the financial cost of distribution is close to zero.

This means messaging 1000s of potential users on LinkedIn, cold emailing, guerilla marketing, and going to places where your users are to endlessly plug your product.

You have to manually acquire and onboard. Every. Single. User.

It’s time intensive and you can’t continue this process past your first initial user base, but you must do it as a launchpad.

The time cost curve of acquiring your initial user base is very expensive at first. It eats up your days.

As you spend money to develop marketing campaigns and sales efforts, your time spent per acquired user begins its decline towards zero.

Once obtaining a core initial user and having some beginning revenue, you must begin automating the user acquisition and onboarding process— you must start to spend money to save time.

Whether that means hiring a marketing team, account executives, or simply running ads yourself.

You must invest in the Big 4: Paid Performance Marketing, SEO, Virality, and Sales.

The financial cost curve of user acquisition is a hump.

Until the highest point of the hump, you’re testing lots of distribution strategies out— and burning a lot of money in the process. After the hump, you’re optimizing your spending and scaling distribution.

At first, your financial cost per user is zero, and as you learn to use paid means to acquire users, the cost curve hill drastically increases.

You’re frantically looking for user acquisition methods that scale, and in the meantime, your costs to acquire users are skyrocketing as you try various approaches.

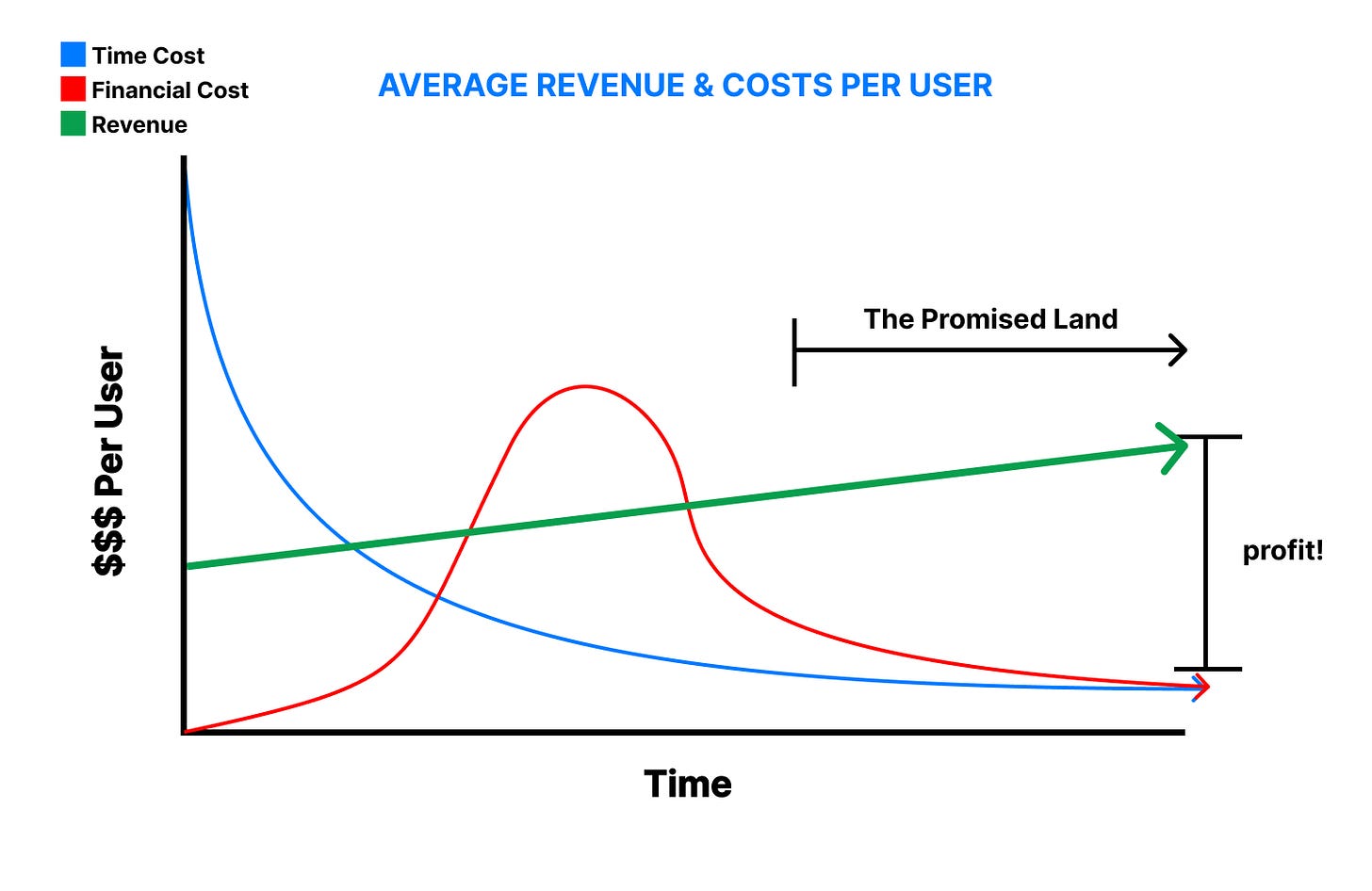

It’s no secret the uphill of the cost curve is dangerous, it’s the hill most startups with traction die on…

Most startups in the process of climbing this hill run out of gas(cash) and burn up(go out of business) before they can coast down the other side.

Some roll back down the hill and become lifestyle businesses that post comfortable low growth.

Few make it to the plains of “The Promised Land”.

Getting over this hump is one of the hardest challenges early-stage startups face, you can have a fantastic product but if you can’t figure out how to get it in front of users— you’re finished.

“If you can get even a single distribution channel to work, you have a great business. If you try for several but don't nail one, you're finished. So it's worth thinking really hard about finding the single best distribution channel.” - Peter Thiel

But once you pass the hump, you know what works in acquiring users for your product and it’s just a process of optimizing to lower your financial acquisition cost per user.

You’re riding the cost hill down.

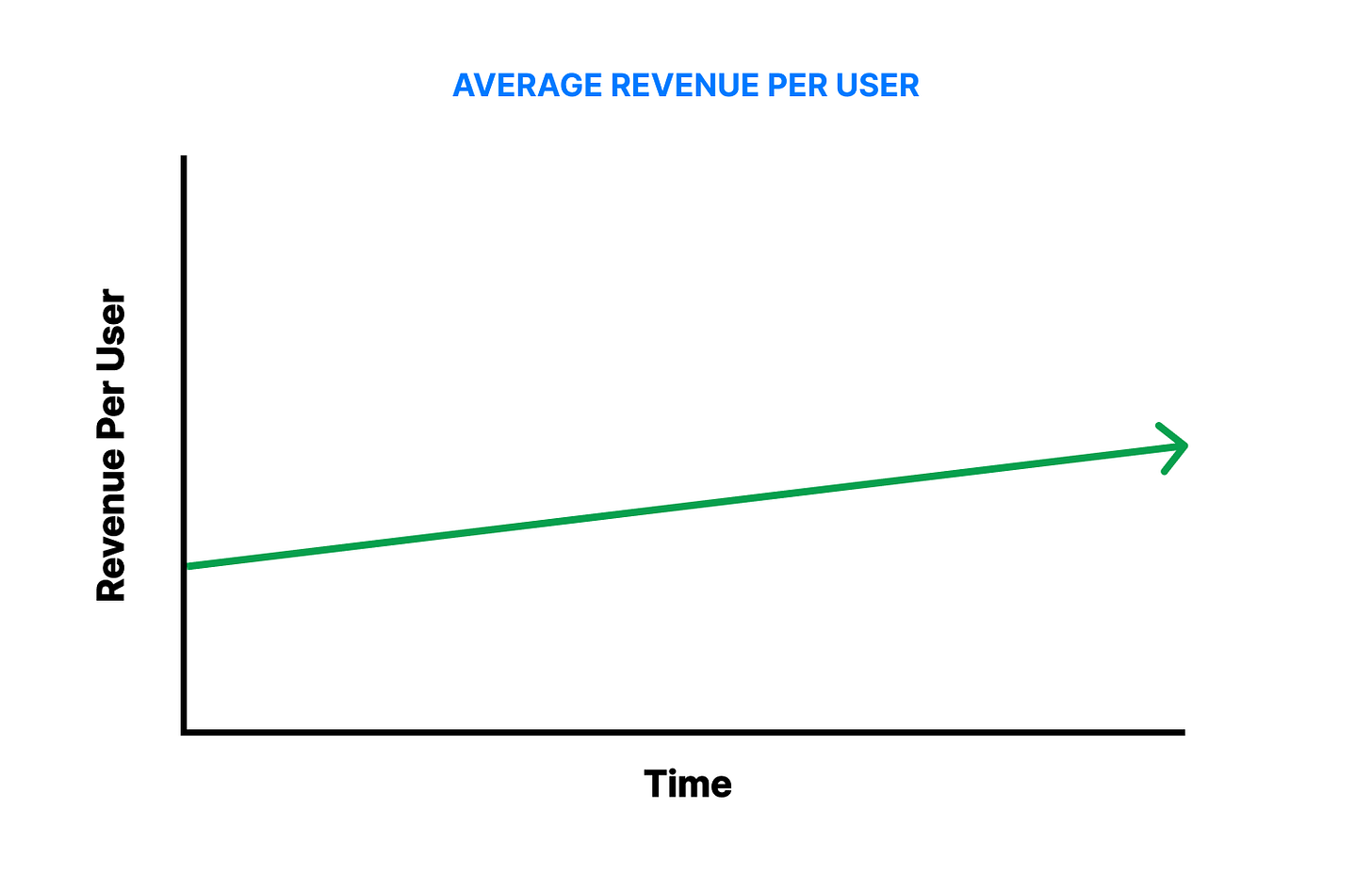

Now that we covered user acquisition costs, what does user revenue look like on this graph?

Revenue per user in a perfect scenario is an incline up. As you gain more users your product becomes more valuable— and you’re able to extract more value per user as a result.

For this chart, I normally just use conservative 3-year projected revenue. The standard for SaaS startups is under 12 months to pay back Customer Acquisition Cost(CAC), this is the high-end of the range— the lower the better.

It’s important to note, this chart is only for identifying where you are in your macro journey of establishing distribution and PMF.

You should use this as a way to identify macro strategy, direction, and focus.

Time Cost can be hard to quantify, you always should be using LTV Gross Profit analysis to calculate your payback period.

Where startups get into trouble is:

1. They transition to financial user acquisition too soon, and as a result:

a. The slope of their financial cost curve is too sharp for their cash reserves.

These startups burn up all their money before they can ride the curve back down, their financial cost curve has a higher hump than the money they have in the bank.

These startups can either raise money/“go for broke” and burn whatever cash they have left in hopes of reaching the downhill of the curve, or they can slide back down the hill and become lifestyle businesses.

A startup with a high financial cost curve normally has a high-ticket product($50k+) where you’re struggling to find scalable distribution. CAC is expensive on high-ticket SaaS, and it’s very expensive to find the distribution channels that work.

Most scaling SaaS companies have a CAC that is around 50-90% of their annual contract value (ACV).

Doing back-of-the-envelope math, you’ll see that the amount of cash you need to experiment with to find distribution for a $50k+ product is a lot.

b. Their product has had no real-time in the market, meaning they have no user feedback and no real idea of their LTV per customer, or their payback period.

They will be the victim of unprofitable campaigns, and burn all their money in what are perceived as “profitable” acquisition strategies.

2. They transition to financial user acquisition too slowly:

They fall victim to ever-lowering month-over-month growth.

Achieving 30% month-over-month growth using time-intensive methods is easy at 50 users, but it is close to impossible to grow 30% month over month with 10,000 users using no paid methods.

Many VCs will then be hesitant to invest in said businesses as the startup is not posting high month-over-month growth for the VC to justify investing to their partners/firm.

In short, the startup does not have any established distribution methods— the investor has to believe that their capital infusion and know-how could help the startup find viable scalable distribution.

This can be overcome by showing an extremely strong PMF.

(see Figma who worked on their product for years before scaling it)

Scaling user acquisition is a delicate balancing act, and I love to draw parallels to my favorite Greek myth of Icarus.

Icarus and his Father Daedalus, imprisoned in a tower on the island of Crete, build wings made of feathers and wax to escape. Before they fly off to escape their imprisonment, Daedalus turns to Icarus and tells him:

“Fly neither too low nor too high, lest the sea's dampness clog your wings or the sun's heat melt them.”

Or in other words in startup speak:

Be careful scaling user acquisition, don’t scale too slow or you will sink, but don’t scale too fast or you will burn up.

Icarus flew too high.

His wings melted before he plunged into the sea and drowned.